Launching funds in stages enables you to prepare in advance with your construction costs in the expertise you will understand when to expect to receive cash. These funds can after that be paid to contractors or any kind of various other third parties that may be owed money as part of the build. First Count on, at the time of composing, has no application charges or booking Click here to find out more charges. Its loan term depends on 35 years, and also they have a typical minimum loan quantity of ₤ 25,000. Haven offers new self build customers as much as 90% LTV, while it offers next-time customers up to 80% LTV.

- Just how to discover the most effective self-build mortgage loan provider for your needs and conditions.

- These kinds of mortgages appropriate for self-builders who will take on most of the job themselves, as well as those who act as job supervisors, hiring tradespeople directly to work hands-on.

- Because it's likely that your project will certainly materialize over a period of time, we'll launch your funds in phases according to the development of the develop.

- You could then need to apply to expand your borrowing, usually at a greater interest rate.

This type of home loan might appropriate if you are able to make a 20% down payment for your story and also additional funds to commence the beginning of the develop. We generally recommend 20% of your complete construct spending plan as an excellent starting indicate begin your self-build project. We are specialists in providing home mortgages for unique self-build tasks and we don't have a 'tick box' strategy to analyzing these types of strategies-- in lots of circumstances, we'll invite builds that standard lending institutions might not accept.

Were Click here for more Entirely Independent

If you possess your existing home or have enough equity in it, you may have the ability to remortgage or secure a swing loan to spend for your brand-new story, fund the develop expenses, and even both. You would then market your old residence once you had actually completed the new one and pay off the finance. Rate of interest on a self construct home loan are higher than basic home purchase/remortgage rates as well as usually vary from 4-6% per annum. You may be tied right into the lender for between one and also three years, once more loan provider as well as product dependent. An evaluation based phase settlement mortgage releases funds after each stage of works are full, where an evaluation has actually occurred revealing an uplift in value. This borrowing choice might not match your develop repayment terms if you have actually chosen a lumber frame construction.

Advantages And Disadvantages Of A Self Develop Home Mortgage

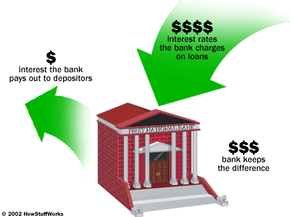

" Modern wood systems constructed to STA Ensure requirements are approved by most, if not all self develop lenders. These are conventional items, with 10,000 s of timber residences built annually. " The majority of our home mortgage products are now cost-based, as this offers clients assurance," says Chris Martin, head of product growth as well as underwriting at BuildStore. This describes when the home mortgage settlements are made to you either after or prior to the appropriate stage is completed. A self-build home mortgage often charges higher prices than standard mortgages. You can discover really affordable self-build home loan rates, specifically if you have a larger deposit.

In this respect it is likely that your application will be decreased if you are incapable to supply any revenue information. The release of phase repayments for your self build home loan will have a tendency to vary from lending institution to lender. Of the two types of self build home mortgage, the financial obligations option is most commonly made use of with the cash for each and every phase paid when the work has been completed as well as a specialist valuer has evaluated the building to that point. Consequently most lenders will certainly desire you to be able to fund the initial 20% around on your own. Self build home loan lenders will typically use this sort of lending on the understanding you have the ways and also know-how to either construct a residence yourself or have the ability to manage its construction.

Unlike with a traditional home mortgage, settlements are made in instalments-- typically, 5 or 6-- while the building progresses. You will possibly locate a substantial variety of the items provided are also discount or variable rates specifically for those with even more versatile or generous options around the stages and advancing funds ahead of time. Various other lending institutions especially some of the high street lenders might just advance funds much additionally right into the completion of the project and hence you will certainly require significantly much more cash aside first to utilize these lenders.

For most people getting their finances in order is an essential starting point for their self build project. If you need to borrow money then locating the ideal mortgage for your construct is important to ensuring the success of the task. The syllabus for the federal government's brand-new Help to Develop system has now been released, offering further details regarding just how self contractors can make use of it to assist finance a task.

The loan quantity relies on providing requirements as well as structure products. Self-build home mortgages can be a wonderful device for helping you accomplish your desire residence at a budget-friendly expense. Getting a specialist mortgage broker actually makes a difference when it comes to taking care of smaller sized, extra niche loan providers as well as products. Only a limited number of loan providers provide self-build home mortgages, so you may have to hunt around a bit extra to discover the ideal bargain. A home loan broker can search the market on your behalf to discover the appropriate one for you.